What the First Month of the Year Really Means for Food and Poverty

January is often treated as a clean start. On the ground, it rarely feels that way.

In West Africa, January is when households take stock. What did December cost? What food is still in the house? What bills are due? What can be postponed, and what cannot?

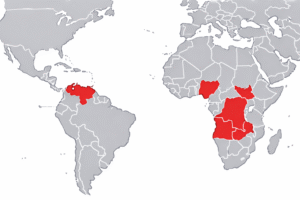

This article looks at Ghana, Sierra Leone, and Nigeria because together they show how one month can carry very different weight depending on income, market access, and national scale.

Nigeria matters because it sets the tone for the region. With more than 220 million people, shifts in food prices, fuel costs, or transport ripple outward, affecting trade flows and market prices well beyond its borders.

Ghana offers a different picture: a country closely watched for inflation trends, port activity, and consumer confidence.

Sierra Leone, smaller and more import-dependent, shows how quickly economic pressure can reach the household level when incomes are irregular and food prices move.

Taken together, these three countries help explain why January is not just another month on the calendar.

What January feels like at household level

December spending does not disappear on January 1.

Food costs rise during the holidays. Transport increases. School-related expenses return. For many households, savings are thin or gone by the time January arrives.

January becomes a month of adjustment. Spending tightens. Meals are planned more carefully. Non-essential purchases are delayed. It is not usually the peak hunger period, but it is often when families start asking how long their food and cash will last.

Harvest timing helps, but only to a point

January often follows the main harvest season in parts of West Africa, which can improve food availability.

In Nigeria, the main harvest typically runs from October to December. January markets therefore tend to be better supplied than during the mid-year lean season, which commonly runs from May to October.

In Sierra Leone, January usually falls before the lean season begins, offering a short window of relative stability.

In Ghana, many key crops are harvested in late third and fourth quarters, supporting supply in early January.

But availability does not equal access. Food can be present in the market while still out of reach for households whose income has not recovered.

January 2026 compared to last year

This January is not the same as last January.

Ghana

In January 2025, inflation in Ghana stood at 23.5 percent. Food prices were rising rapidly, and households were under severe pressure.

By late 2025, inflation had eased sharply. Official data showed inflation at 6.3 percent in November 2025, including a slowdown in food inflation. Entering January 2026, price increases are slower, even though prices remain high.

For households, this does not mean relief. It means the pressure is no longer accelerating at the same speed.

Nigeria

Nigeria also enters 2026 with easing inflation. Official figures reported inflation at 14.45 percent in November 2025.

Still, food affordability remains a major concern. High food prices, fuel reforms, and transport costs continue to shape daily decisions. January for many Nigerian households is about managing scarcity, not rebuilding savings.

Sierra Leone

In Sierra Leone, inflation eased to 4.44 percent year on year in October 2025, with some months showing negative month-on-month changes.

This can make January feel slightly less volatile at the market. But reliance on imported food and irregular incomes means households remain highly exposed to any disruption.

Poverty does not reset each month

Poverty does not move neatly from month to month in official statistics.

What does change is pressure.

January brings school fees, transport costs, and food purchases back into focus. For households already close to the edge, even small price increases or income gaps can push nutrition and health decisions into harder territory.

Seasonal cycles matter more than headlines.

What January tells us about the year ahead

January does not predict the future, but it shows where households are starting from.

Ghana enters 2026 with improved inflation trends but still faces the challenge of translating macro stability into household relief.

Nigeria enters the year with easing inflation but unresolved food affordability that will shape stability across the region.

Sierra Leone enters with softer inflation data but remains vulnerable to shocks that can reach families quickly.

The road in 2025 was difficult.

January shows how much people are carrying into 2026.

Food security this year will depend on prices, incomes, climate conditions, and whether policy changes reach households before the next lean season arrives.

Sources

- Ghana Statistical Service, Consumer Price Index Reports

https://www.statsghana.gov.gh - National Bureau of Statistics, Nigeria, Consumer Price Index Reports

https://www.nigerianstat.gov.ng - Statistics Sierra Leone, Consumer Price Index Reports

https://www.statistics.sl - World Food Programme (WFP), Hunger Hotspots Reports

https://www.wfp.org/publications/hunger-hotspots-fao-wfp-early-warnings-acute-food-insecurity - Food and Agriculture Organization of the United Nations (FAO), Seasonal and Food Security Reporting

https://www.fao.org - Reuters, West and Central Africa food security reporting

https://www.reuters.com/world/africa